Levels.fyi reviews hundreds of offer letters & pay statements each month. We help candidates negotiate their job offers and help compensation teams at companies stay abreast of market changes with our compensation bencharking suite.

New: Recruiters & Founders - improve your candidate closing rates with Interactive Offers. Help candidates visualize & understand their total compensation (including options / equity).

The even equity vesting schedule (25% each year for 4 years) is quickly becoming a thing of the past. Many companies are now shifting to front-loaded vesting - often with a 40-30-20-10 (% vesting each year) structure. With it, the era of “rest and vest” comes to an end.

Originally pioneered by Sergej Sonic at Alphabet, DoorDash, and Rippling, this shift isn't just a simple change in numbers; for companies, it’s a philosophical pivot toward a more dynamic, performance-driven compensation strategy. Top performing employees stand to benefit while others will have more uncertainty of compensation in subsequent years.

Outline:

- Understanding Front-Loaded Vesting

- Why companies are shifting & What you need to know

- Which companies have shifted

- Conclusion

Understanding Front-Loaded Vesting

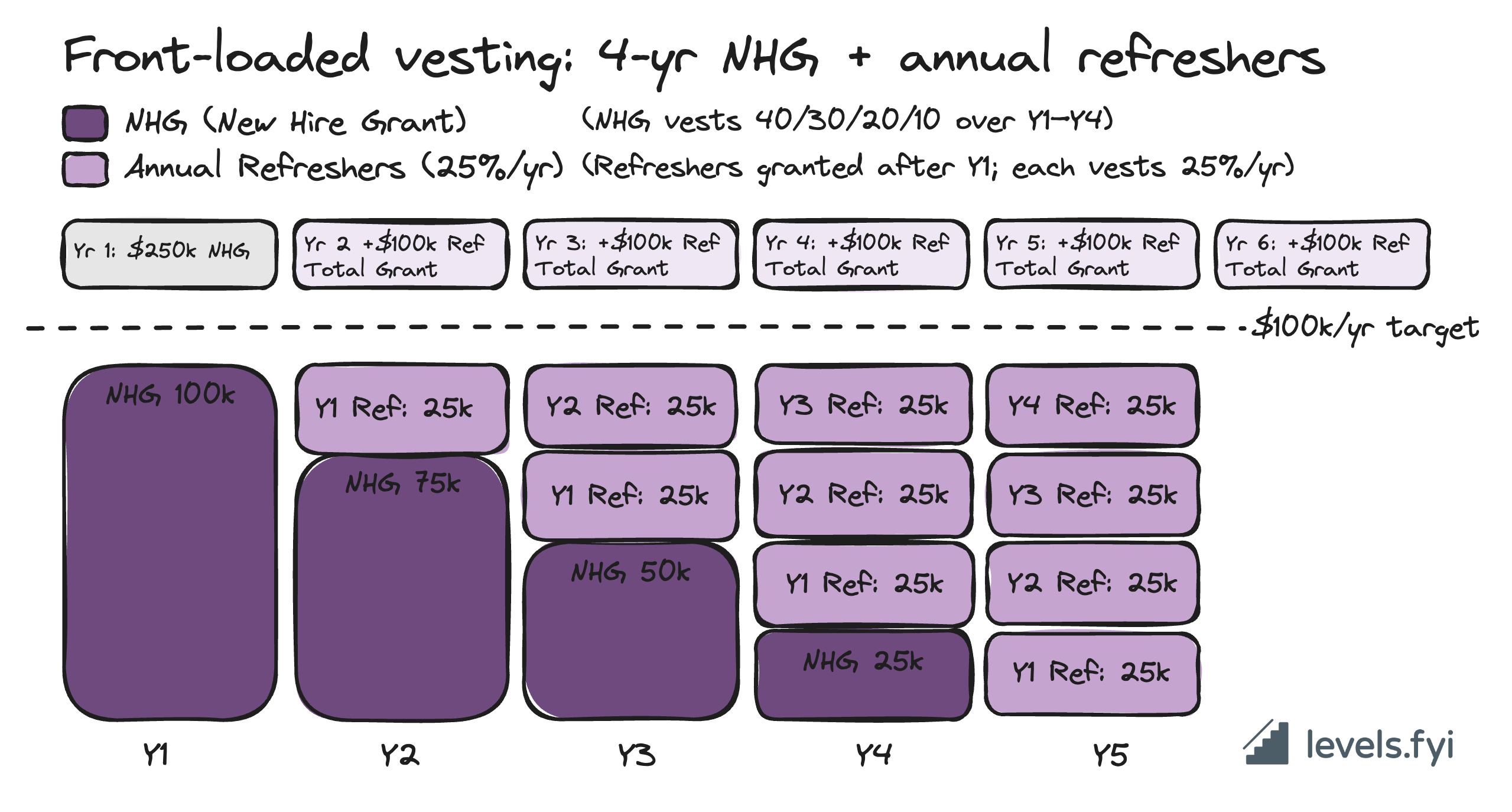

TL;DR: A front-loaded New Hire grant vests more in earlier years than later years, with annual performance-base grants replacing the New Hire grant over time. Higher performance builds compounding upside.

How it works (with numbers)

Imagine your target is $100k/year in equity at “Meets Expectations.” The graphic below shows how Annual Performance Grants (Refreshers) supplement the New Hire Grant to achieve the target equity each year. For better performers, refreshers can be higher than target. A common approach is to apply a multiplier to the target equity.

*Chart recreated based on Sergej Sonic’s front-loaded vesting sample model

Example setup

- Traditional (25/25/25/25): $400k new‑hire grant → $100k vests each year for years 1–4.

- Front‑Loaded (40/30/20/10) + Annual Performance Grants: $250k new‑hire grant that vests $100k (Y1), $75k (Y2), $50k (Y3), $25k (Y4). A front-loaded grant would be 37.5% less equity in your offer letter compared to a traditional grant even if the total compensation they’re targeting is the same. Each year you also receive a performance grant targeting $100k total equity compensation that vests 25% / yr for 4 years.

Layering math at target (1.0× every year)

| Year | From new‑hire | From prior performance grants | Total vest |

|---|---|---|---|

| 1 | $100k | $0 | $100k |

| 2 | $75k | $25k | $100k |

| 3 | $50k | $50k | $100k |

| 4 | $25k | $75k | $100k |

| 5+ | $0 | $100k (4 overlapping grants × $25k) | $100k |

Performance upside (e.g., 1.3× every year)

A 1.3× multiplier makes the yearly grant $130k, so each of its four portions is $32.5k. As multiple years overlap, good performance compounds:

| Year | From new‑hire | From prior performance grants | Total vest |

|---|---|---|---|

| 1 | $100k | $0 | $100k |

| 2 | $75k | $32.5k | $107.5k |

| 3 | $50k | $65.0k | $115.0k |

| 4 | $25k | $97.5k | $122.5k |

| 5+ | $0 | $130.0k | $130.0k |

Key takeaway: At target, the design flattens your annual vest to ~$100k. If you outperform, the staircase steps up over time; if you underperform, it steps down.

Why companies are shifting & What you need to know

TL;DR: Companies can lower stock-based compensation (SBC) for more attractive financial statements. Employee compensation is more heavily dependent on performance - good news for companies & their top performers, but even for top employees, only if a company manages their performance cycles well. If you’re considering an offer from a front-loaded company, compare and get more details on early vs. steady-state compensation.

For you, that means earlier value plus a clearer link between impact and long-term equity. The trade-off: pay close attention to how each company handles refreshers, since they now drive much more of your runway.

1) “Rest and Vest” may be a thing of the past. Front-loaded vesting puts more weight on performance-based refreshers and bonuses given each year. In older schedules, stock spikes after hire inflated comp regardless of performance (e.g. Nvidia’s 2022/23 grants). Now, contribution matters more.

2) More attractive financials for investors, lower upfront grant for employees. Even if the total annual compensation is the same, front-loaded vesting schedules come with a lower initial grant due to the percentage split. This results in less stock-based compensation (SBC) on income statements for companies. Investors often review these numbers to assess the health of a company.

3) More reliance on company performance management. Refreshers take center stage with front-loaded vesting schedules. Companies need to have really strong performance management procedures in place to ensure employees are targeted for additional performance grants. If not managed right, this could actually cause more employee churn. Employees now have to rely more on the benevolence of a company in subsequent years. It’s prudent for prospective employees to ask how refreshers are decided and what baseline of equity the company is targeting each year for the role.

4) Smoother compensation - less market swing impact & no cliffs. Annual refreshers can help top up employees in down markets and make employees ‘whole’ when their equity value has taken a dip. Additionally, instead of a drop-off at year 4–5, layered grants keep target equity smooth each year. Actual vested equity becomes driven more by employee performance and company stock performance, rather than the timing of a candidate’s start date.

5) Clearer annual rhythm. All employees become eligible for annual performance grants with the performance management and compensation planning schedule. Eligibility is unlocked as soon as performance is measured, rather than having to wait for the new hire grant to expire. For managers, this also simplifies planning cycles: all performance rating eligible employees are performance grant eligible.

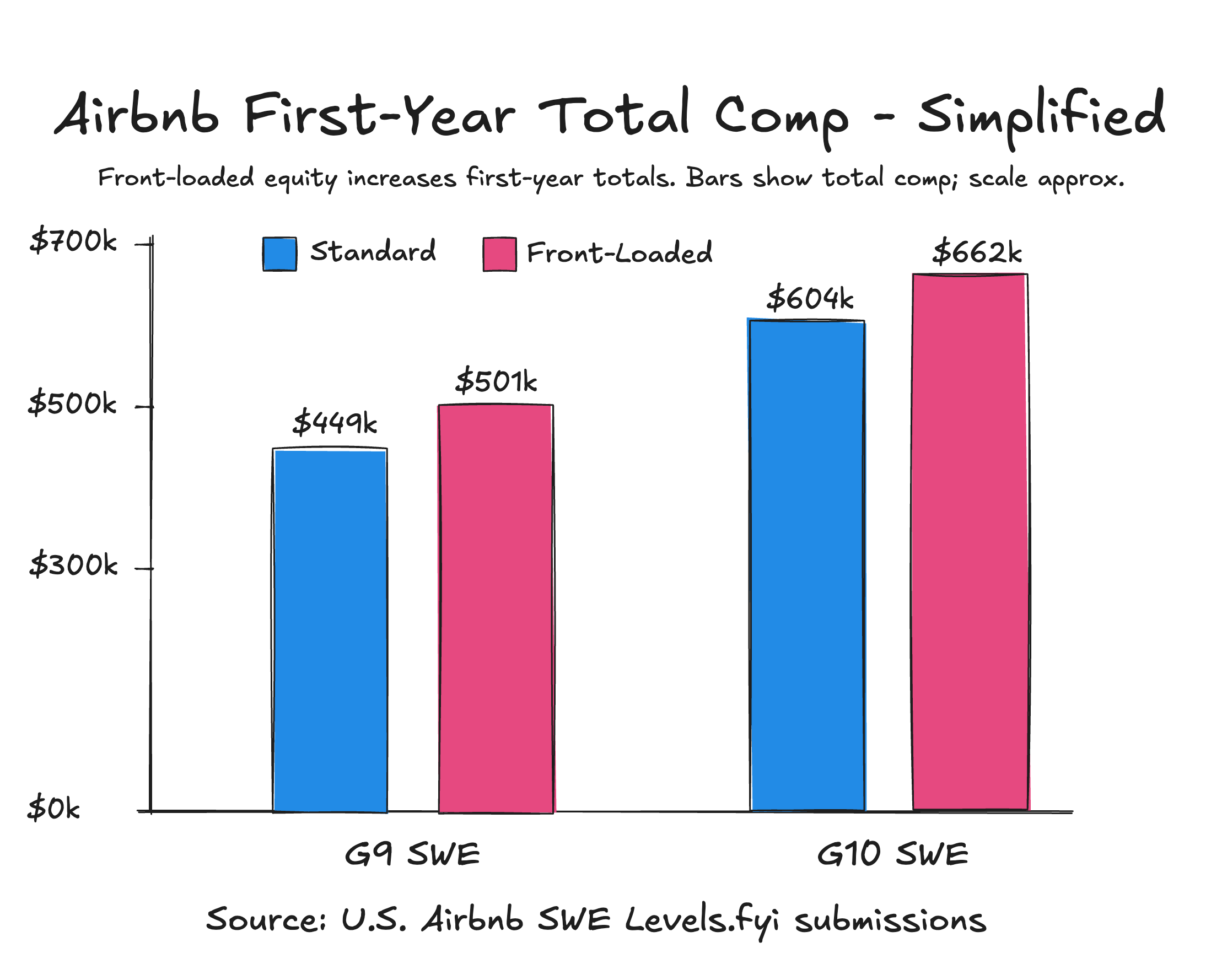

6) More competitive in Year 1 (and Year 2). Given this is a new format, companies have been making Year-1 and Year-2 offers more competitive to entice candidates. It’s important to recognize the first year compensation isn’t guaranteed for all years and employee performance will ultimately dictate whether they can earn the same amount in subsequent years. This means companies may be more willing to take a risk on stretching initial equity offers knowing that if performance doesn’t pan out, they can course-correct.

*Airbnb has been giving offers with higher first year total compensation after shifting to a front-loaded vesting schedule.

*Airbnb has been giving offers with higher first year total compensation after shifting to a front-loaded vesting schedule.

Which companies have shifted

TL;DR: From Oracle to Nvidia to Airbnb, front-loading is spreading fast—expect to see it in your own offers.

Recent additions

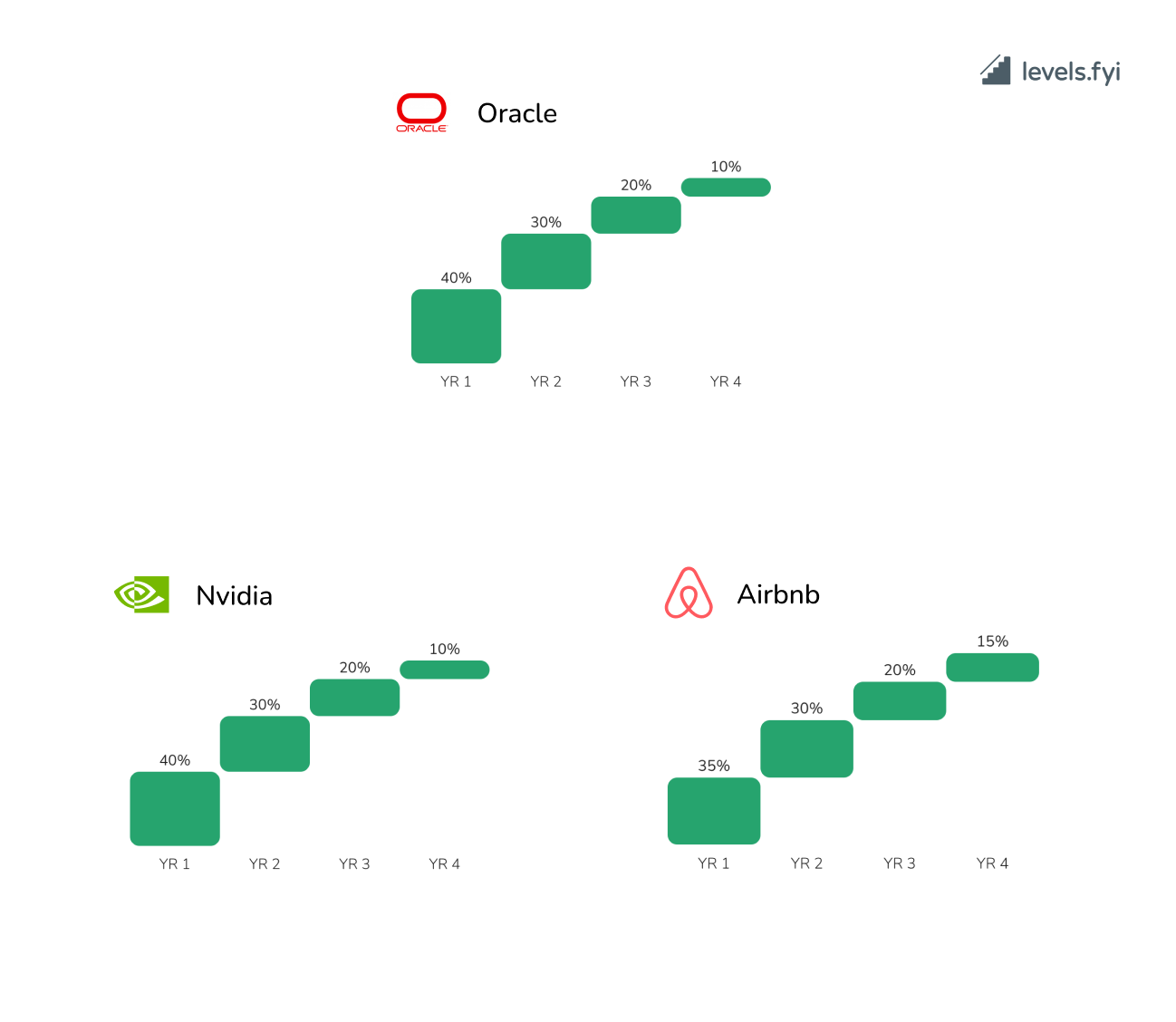

Oracle - 40/30/20/10

As of this writing, Oracle is the newest addition to the front-loaded vesting schedule crew with a 40/30/20/10 schedule similar to Nvidia. With 100k+ employees, Oracle shifting to a front-loaded vesting schedule along with other industry leaders is a sign that this type of vesting isn’t just some trend—it’s here to stay.

Airbnb - 35/30/20/15

Airbnb recently revamped their equity structure to experiment with a 35/30/20/15 vesting schedule, away from their standard 4-year even vesting.

Aside from following the market, there is some speculation that Airbnb has shifted their vesting schedule to provide better first-year offers as well, with the goal of attracting talent from the higher tier of tech companies such as FAANG.

Nvidia - 40/30/20/10

Nvidia has also recently updated their vesting schedule to front load it, but with a unique twist we expect to see other companies following soon. Nvidia is guaranteeing a minimum refresher amount for equity, likely to allay employee concerns about compensation drop off. So as the percent of the initial grant goes down over the years, they guarantee that each year the employee will get a minimum value of equity that typically aligns with the first year of compensation.

With their 40/30/20/10 schedule, the stock grant vests quarterly without a cliff.

Early adopters

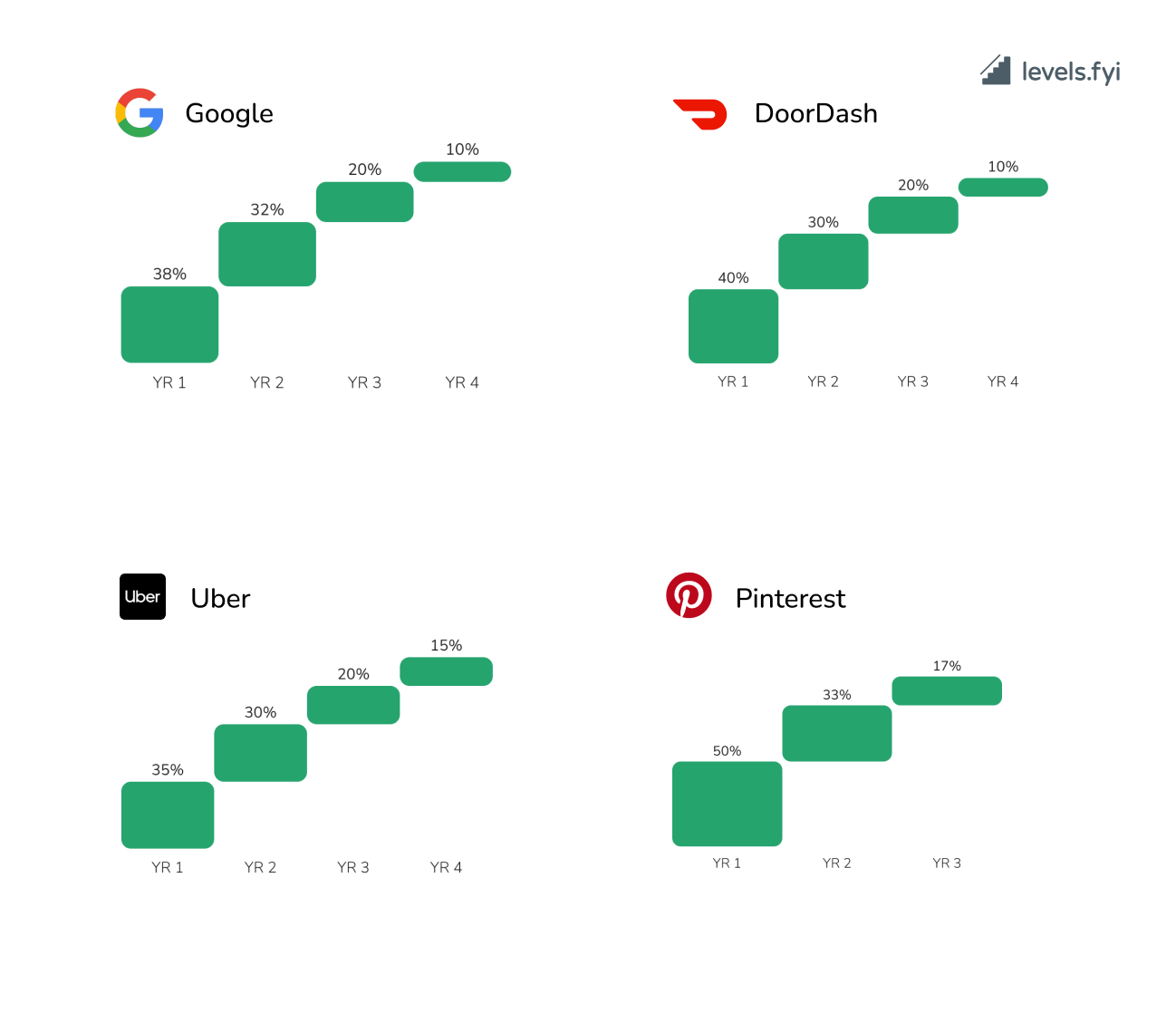

Google - 38/32/20/10

Google has experimented with quite a few vesting schedules over the past few years, including offering different schedules for certain employees. We’ve seen 33/33/22/12 or 25/25/25/25. Other less common schedules we saw: 36/28/20/16, 40/20/20/20, and 40/28/20/12.

Their current standard setup is 38/32/20/10, vesting monthly without a cliff.

DoorDash

One of the earliest large consumer-tech adopters of front-loaded vesting. The 40/30/20/10 split lets DoorDash present stronger first-year equity while relying on refreshers to keep later-year comp competitive.

Uber

Uber uses a gentler taper that still front-loads the majority of value into the first two years. It balances compelling first-year offers with a smoother decline that pairs well with annual refreshers.

Pinterest is the most unique one out of this group with a three-year schedule with 50% vesting in the first year. The stock grant also vests quarterly with no cliff. The 3 year typical front-loaded structure would be 50-33-17 NHG + 33-33-33 PGs, 3 year grants are more popular with smaller & more established (low growth) companies.

Conclusion

Front‑loaded vesting is trending with high performing tech companies that have been the pioneers in ‘pay-for-performance’ culture: higher Year‑1 value, a smaller initial grant, and refreshers as the engine of long‑term pay. For candidates receiving this type of offer: evaluate offers on two tracks —first‑year and steady‑state — and insist on more information around refresher rules before you sign.

Levels.fyi has unparalleled insight on compensation trends through our Negotiation Service and compensation data.

- Candidates: We’ve helped thousands of people with offers over the last year understand and navigate the fast-changing compensation philosophies. If you’re looking for a job, our resume review can help. If you’re getting close to the offer stage, we can help you negotiate.

- Compensation Professionals: Understanding the nuances of each plan is critical for designing your program. Stay ahead of the curve with our real-time data & insights.

- Recruiters: Equity, and its future potential, is often misunderstood. Don’t lose top candidates to confusion. See how our Interactive Offers can improve your closing rates.